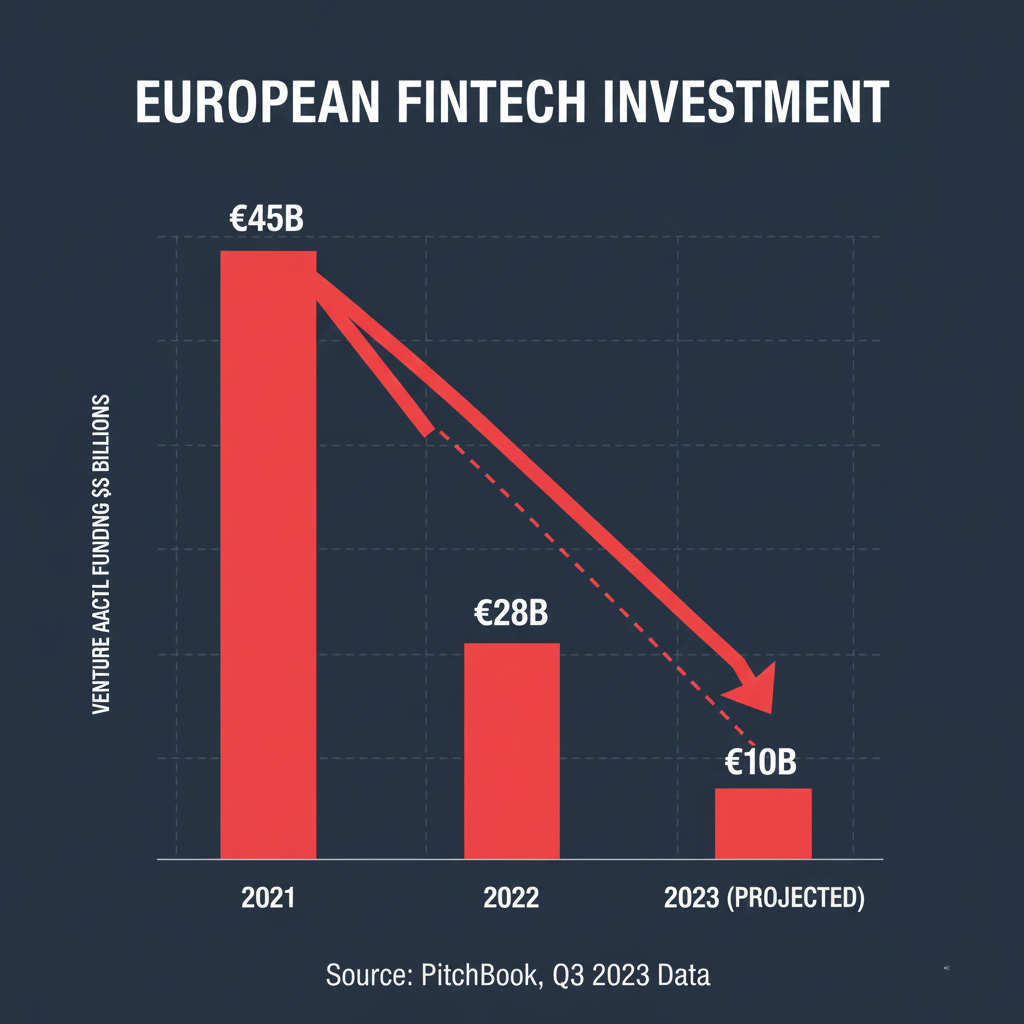

The End of the Pandemic Boom

Just a few years ago, particularly in 2021 and early 2022, VC money was flowing freely into European fintechs. Investors were chasing growth, driving valuations to unsustainable heights. However, The Banker notes that this “party is over.”

Rising interest rates, high inflation, and geopolitical uncertainty have caused venture capitalists to slam on the brakes. Funding has dried up significantly, leaving many startups that burned through cash to acquire customers in a precarious position. The market is now fragmented, with too many players chasing too few customers in an environment where capital is scarce.

The Shift from Growth to Profitability

The defining characteristic of this new era is a pivot from hyper-growth to sustainable profitability. In the past, fintechs could raise massive rounds based solely on user-growth metrics, regardless of their burn rate. Now, investors demand a clear path to profitability.

Companies that raised funds at peak valuations are facing difficult choices. To extend their “runway,” many are cutting costs, including layoffs. Others are forced into “down rounds”—raising new capital at a lower valuation than their previous round—which is a painful reset for founders and early investors.

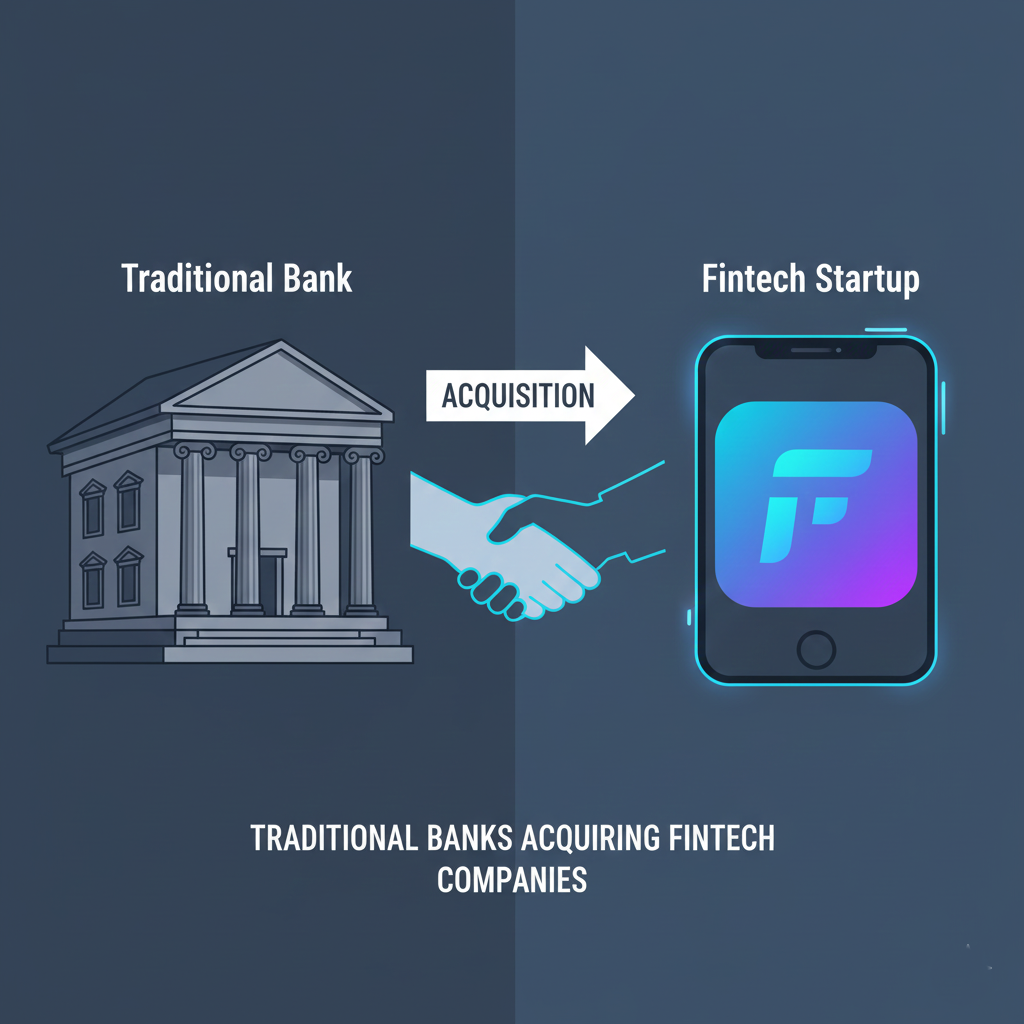

The Coming Wave of M&A: Incumbents vs. Challengers

This combination of low valuations and scarce funding creates the perfect storm for consolidation. The Banker’s analysis predicts an uptick in M&A activity driven by two main dynamics:

- Fintech-on-Fintech: Stronger, well-capitalized fintechs will acquire weaker competitors. This allows them to acquire technology, talent, or customer bases cheaply, removing competition and solidifying their market position.

- Banks Acquiring Fintechs: Traditional incumbent banks, which are currently flush with cash due to higher interest rates, have been watching from the sidelines. Previously, fintech valuations were too high for banks to justify acquisitions. Now that valuations have reset to realistic levels, banks are expected to swoop in to buy fintechs that offer specific technological capabilities or niche market access that the banks lack.

Regulatory Pressure Adds Fuel to the Fire

Finally, regulators across Europe are taking a much closer look at fintechs as they scale. Increased scrutiny means higher compliance costs and the need for robust governance structures. Many smaller, early-stage fintechs simply cannot afford the infrastructure required to meet these regulatory demands, making acquisition by a larger, compliant entity their only viable exit strategy.

The European fintech landscape is maturing. The next phase will not be defined by the number of new unicorns, but by who survives the coming consolidation to build sustainable, profitable financial institutions.

Leave a comment