In a searing economic breakdown, Robert Reich, Professor of Public Policy at UC Berkeley, explores the dangerous collision between political rhetoric and geological reality. The latest flashpoint? Potash. While headlines focus on the bravado of trade negotiations, the underlying story is one of extreme vulnerability for the American farmer and consumer.

What is Potash and Why Does it Matter?

Potash isn’t a luxury good; it is a biological necessity. It is the potassium required for modern agriculture to thrive.

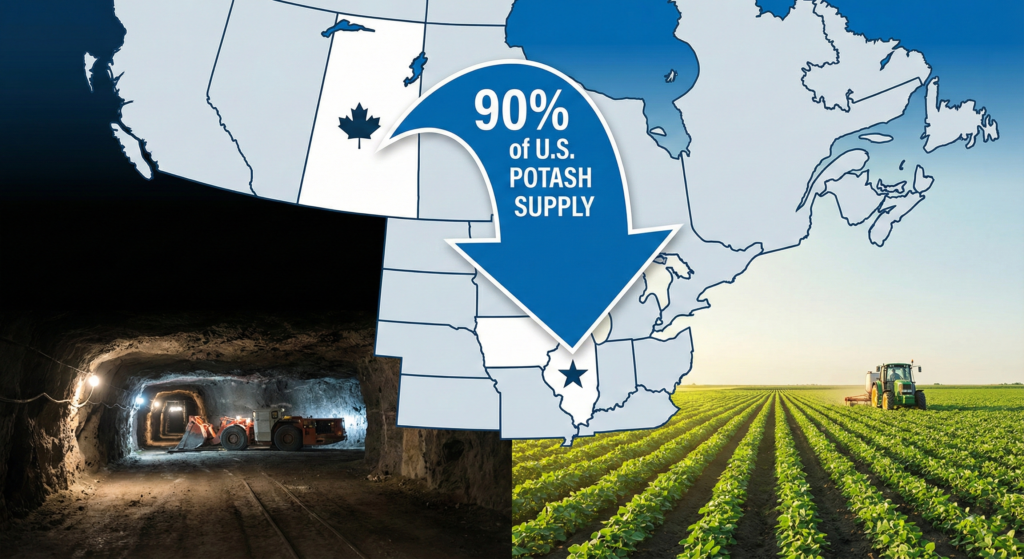

- The Dependency: American farmers rely on Canada for nearly 90% of their potash supply.

- The “Saudi Arabia of Potash”: Canada, specifically Saskatchewan, sits on the largest and highest-quality potash deposits in the world.

- The Hard Wall of Geology: Unlike software or manufactured goods, you cannot simply “innovate” a mineral deposit into existence. As Reich notes, “Geology doesn’t care about tweets”.

The “Own Goal”: How Tariffs Punish the U.S.

The Trump administration’s move to threaten tariffs on Canadian potash is framed as a show of strength, but Reich argues it actually reveals a lack of economic literacy.

- Immediate Market Shock: The moment tariffs were mentioned, potash prices surged in the commodities markets. This wasn’t a cost paid by Canadian companies, but by the farmer in Iowa and the producer in the Midwest.

- Inelastic Demand: Farmers cannot stop fertilizing their crops without risking total failure. Because they must have it, they are forced to pay whatever price the market demands, regardless of how high the tariffs drive it.

Who Really Wins and Who Pays?

While the official narrative claims tariffs “even the playing field,” the actual flow of money tells a different story.

- The Winners: Speculators and trading houses that thrive on market volatility. Chaos in the supply chain allows traders to make millions while the real economy suffers.

- The Losers: Family farms operating on razor-thin margins. A 20-30% spike in fertilizer costs can be an existential threat to a farm’s viability.

- The Consumer: Ultimately, these costs are passed down. Higher input costs for farmers mean higher grocery bills for every American family.

Structural Power vs. Political Bluster

Canada’s response has been one of “calm confidence”. Because they control an essential resource that the U.S. cannot replace, they hold structural leverage that outweighs political posturing. By attacking this bridge, the U.S. administration isn’t showing strength—it’s exposing its own jugular.

A Lesson in Hubris

The potash crisis serves as a textbook example of the limits of political will. You cannot bully a supply chain that you do not control. As long as leaders ignore the basic mechanics of the resources we rely on, American farmers and consumers will continue to pay the “uncertainty premium”.

Leave a comment