For decades, Moore’s Law promised that technology would get faster and cheaper. But in late 2025, that promise feels broken. Whether you are looking at the latest GPUs or simply trying to upgrade your RAM, prices are hitting record highs.

While many blame “corporate greed,” the reality is a far more complex web of three-layered monopolies and a global shift toward Artificial Intelligence (AI) that is starving the consumer market of its most basic components.

1. The Retail Level: Nvidia’s 92% Market Grip

At the consumer level, competition has effectively vanished. Nvidia currently controls over 90% of the discrete GPU market. This dominance allows them to set the “new normal” for pricing.

- The Price Shift: In 2010, a flagship GPU cost roughly $500. Today, high-end cards like the RTX 5090 are launching with MSRPs near $1,999, often retailing for much more due to scarcity.

- AI Priority: Because AI data centers offer significantly higher profit margins than gaming, manufacturers are diverting limited resources away from consumer GeForce cards toward enterprise-grade AI accelerators.

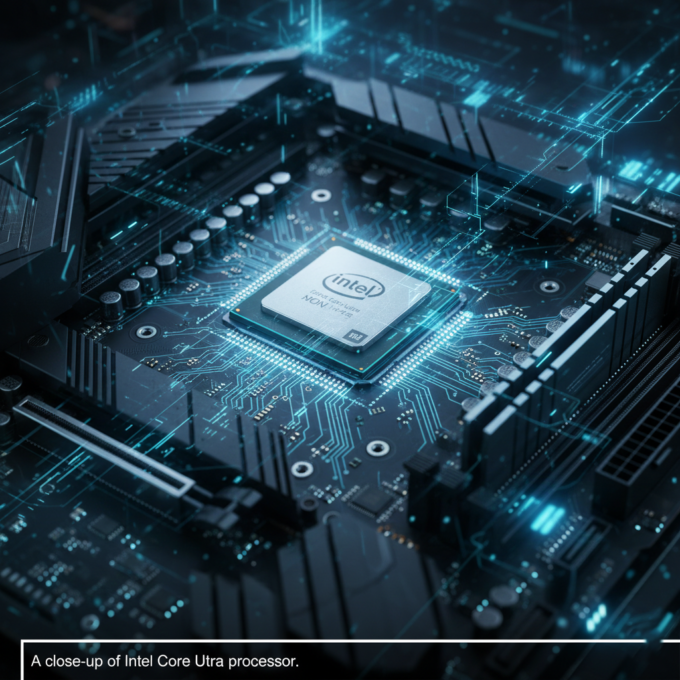

2. The Manufacturing Level: The TSMC Bottleneck

Every major chip designer—Nvidia, AMD, Apple, and even Intel—now relies on TSMC (Taiwan Semiconductor Manufacturing Company).

- Wafer Costs: Manufacturing on the cutting-edge 3nm and 2nm nodes is incredibly expensive. Reports indicate that a single 2nm wafer can cost upwards of $30,000.

- No Alternative: TSMC is currently the only company capable of high-volume production for sub-5nm chips using advanced EUV lithography. This gives them immense pricing power over the entire tech industry.

3. The Equipment Level: The ASML Literal Monopoly

To build the factories that make the chips, companies must buy specialized machines from a Dutch company called ASML.

- EUV Lithography: ASML is the only company in the world that makes Extreme Ultraviolet (EUV) lithography machines.

- The $400 Million Tool: Their latest “High-NA EUV” machines, essential for the next generation of 2nm chips, cost roughly $400 million each. These costs are eventually passed directly down to the person buying a graphics card or a laptop.

4. The 2025 “Memory Super-Cycle”

As we head into 2026, a new crisis has emerged: the VRAM and RAM shortage.

- AI Hunger: Data centers are consuming massive amounts of High Bandwidth Memory (HBM). This has diverted manufacturing capacity away from standard DDR5 and GDDR7 memory used in gaming PCs.

- Price Spikes: Wholesale prices for memory have seen jumps of nearly 300% in just three months, forcing system builders to issue broad price resets.

Conclusion: Buy Now or Wait?

With TSMC capacity booked through 2026 and the AI boom showing no signs of slowing down, the era of “cheap hardware” is on a forced hiatus. For gamers and professionals, the current advice from industry experts is clear: if you need to upgrade, do it now before Q1 2026 contracts lock in even higher baselines.

Watch the full explanation of the hardware monopoly here: This is Why Hardware Prices are Going Up… Again | Linus Tech Tips

Leave a comment