The “Insane Plan” for Venezuelan Oil

According to Senator Chris Murphy, the U.S. is embarking on a path that fundamentally reshapes the global order. Following classified briefings, Murphy described the strategy as “stealing the Venezuelan oil at gunpoint” to use as leverage to micromanage the country for an undefined period.

Unlike past interventions, the current administration has been remarkably blunt about its intentions. Vice President JD Vance stated on national television that the goal is to “control the incredible natural resources of Venezuela” for the benefit of U.S. citizens. This shift from “spreading democracy” to open resource acquisition has led many to label the new policy as one of “colonialism” .

China: The “Rational” Global Power?

Former U.S. Ambassador Michael McFaul warned that if the U.S. continues to act like an “imperial rogue state,” more countries will lean toward China.

- The Rules-Based Order: Outside the West, China is increasingly viewed as the more rational, peaceful, and rules-abiding power.

- Military History: While the U.S. has launched over 50 regime change operations since WWII, China hasn’t been involved in a major war since 1979.

This perception is already yielding results. Canada’s Prime Minister is reportedly planning a trip to Beijing specifically to reduce economic reliance on the U.S. following these aggressive moves.

The Energy Myth: Why China Doesn’t Need Venezuela

Conservative commentators like Glenn Beck have argued that the move hits China where it hurts: their energy supply. However, the data paints a different picture:

- Energy Independence: China is roughly 80% energy independent.

- Diversification: Only about 2% of China’s energy imports come from Venezuela.

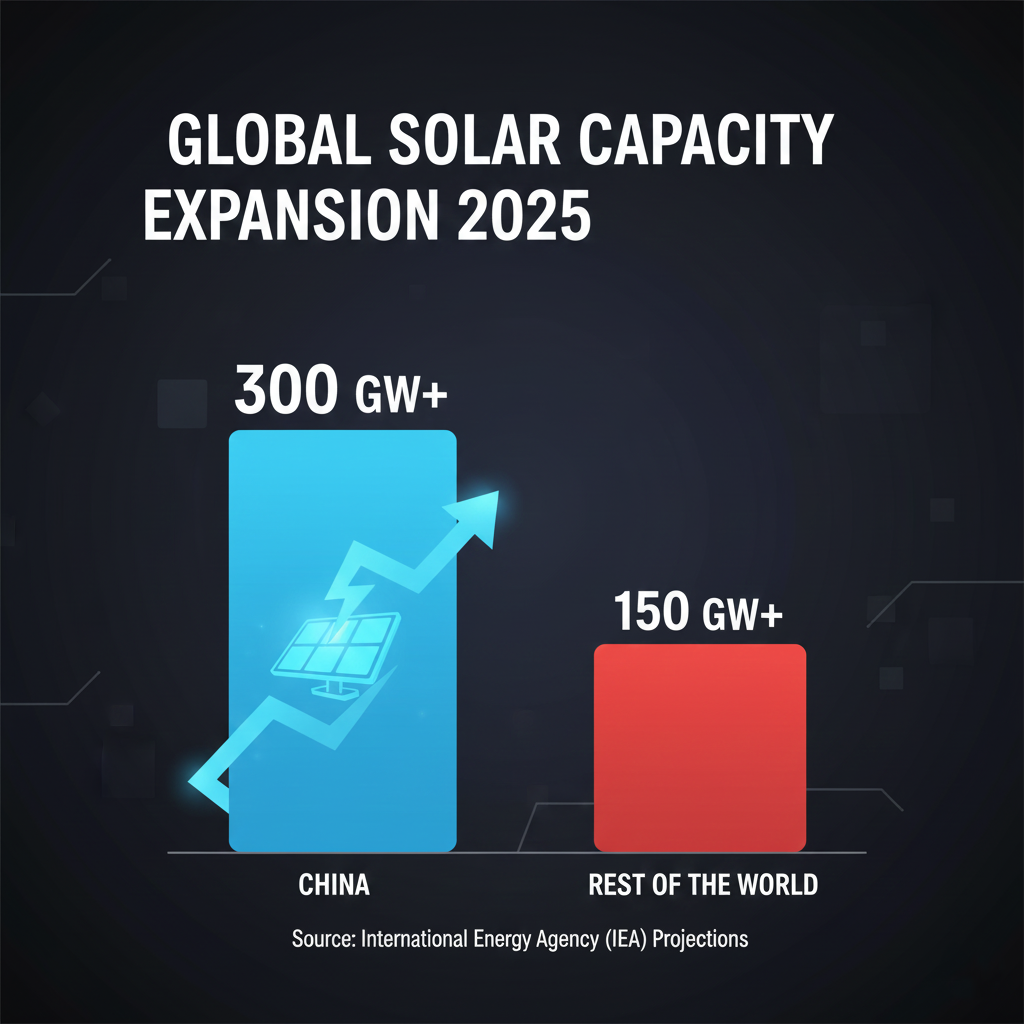

- Renewable Race: In the first half of 2025, China added more than twice as much solar capacity as the rest of the world combined.

Ironically, if the U.S. floods the market with seized Venezuelan oil, it will likely lower global prices, which actually benefits Chinese refiners and consumers.

Domestic Motivations and Corruption Claims

Critics suggest the intervention serves domestic political and financial ends:

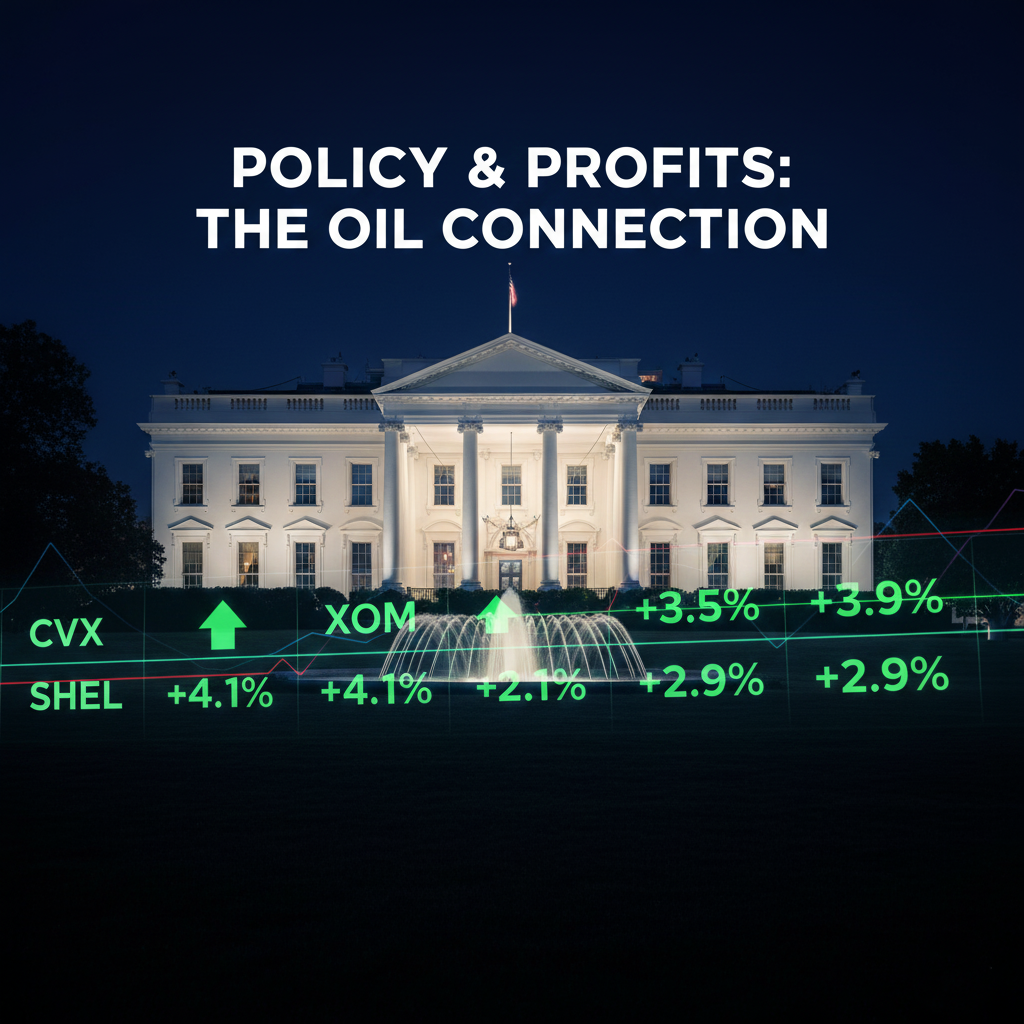

- Stock Market Stimulus: Major U.S. oil stocks surged immediately, with Chevron gaining $35 billion in market cap in a single day.

- Offshore Accounts: There are reports that proceeds from seized oil will be held in offshore accounts controlled by the President rather than the U.S. Treasury.

- The Midterm Factor: The President himself admitted the need to “win the midterms” to avoid potential impeachment, suggesting the conflict is a move to prop up the economy before elections.

This perception is already yielding results. Canada’s Prime Minister is reportedly planning a trip to Beijing specifically to reduce economic reliance on the U.S. following these aggressive moves.

The Energy Myth: Why China Doesn’t Need Venezuela

Conservative commentators like Glenn Beck have argued that the move hits China where it hurts: their energy supply. However, the data paints a different picture:

- Energy Independence: China is roughly 80% energy independent.

- Diversification: Only about 2% of China’s energy imports come from Venezuela.

- Renewable Race: In the first half of 2025, China added more than twice as much solar capacity as the rest of the world combined.

Ironically, if the U.S. floods the market with seized Venezuelan oil, it will likely lower global prices, which actually benefits Chinese refiners and consumers.

Domestic Motivations and Corruption Claims

Critics suggest the intervention serves domestic political and financial ends:

- Stock Market Stimulus: Major U.S. oil stocks surged immediately, with Chevron gaining $35 billion in market cap in a single day.

- Offshore Accounts: There are reports that proceeds from seized oil will be held in offshore accounts controlled by the President rather than the U.S. Treasury.

- The Midterm Factor: The President himself admitted the need to “win the midterms” to avoid potential impeachment, suggesting the conflict is a move to prop up the economy before elections.

Leave a comment